Financials

Investment of The Colorado Trust’s assets are managed by the Investment Committee of the Board of Trustees. The principle investment objective is to maintain the real value of the investments in perpetuity while allowing for suitable grant expenditures that facilitate the fulfillment of The Colorado Trust’s mission. To achieve this, the overall goal is to earn 5% plus inflation. The Colorado Trust invests in a diverse mix of asset classes to reduce volatility and overall investment risk. For more detail on our investments, please consult any of our past tax returns (Form 990-PF) below.

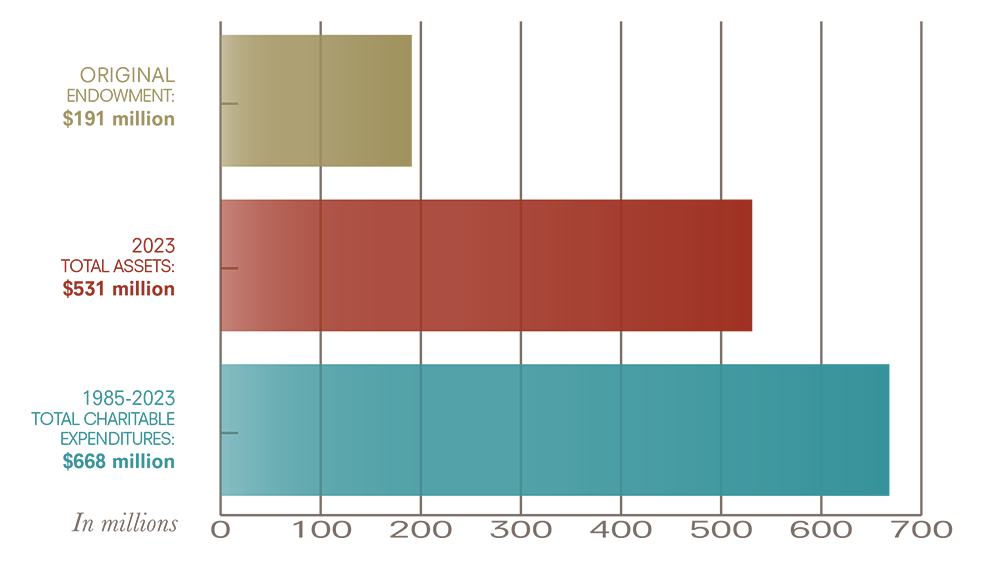

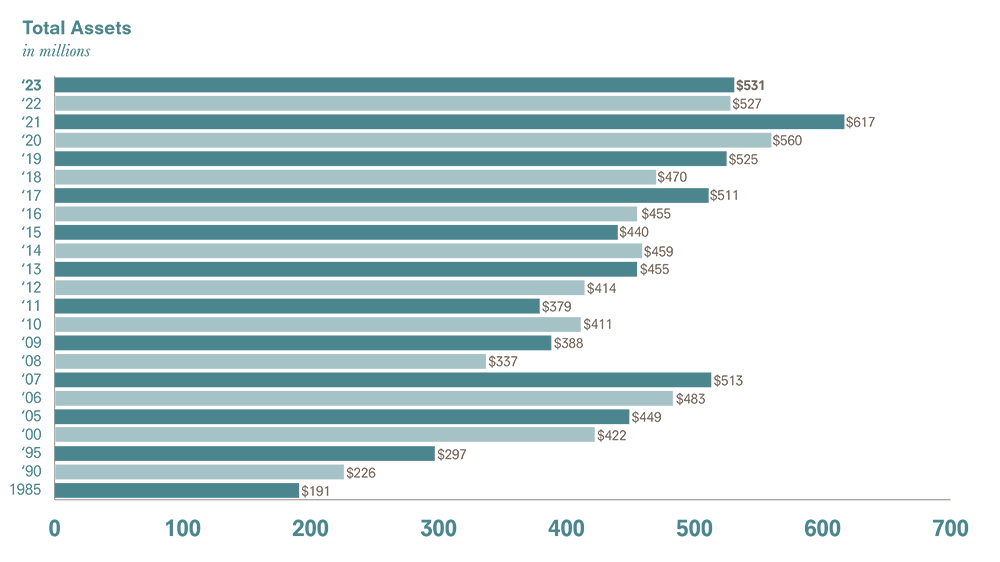

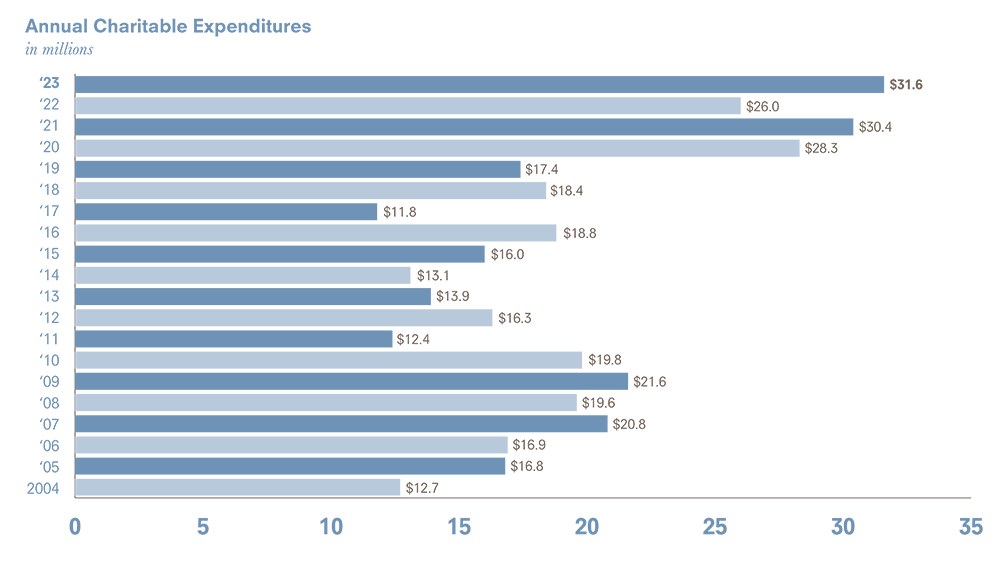

The Colorado Trust’s net assets and liabilities were more than $531 million as of Dec. 31, 2023. Net gain on investments and other transactions in 2023 was $48.2 million. The Colorado Trust provided more than $31.6 million for charitable expenditures in 2023. Program services expenditures accounted for 85.8% of total expenses in 2023, down from 90.2% the year prior.

Since its inception in 1985, through 2023, The Colorado Trust has provided over $668 million in charitable support to grantees across Colorado.

Financial statements

The Colorado Trust retains independent auditors to audit its financial statements. The auditors report to the Audit Committee of The Colorado Trust Board of Trustees.

To download The Trust’s most recent audited financial statements, please click on the following links:

- 2023 Audited Financial Statements

- 2022 Audited Financial Statements

- 2021 Audited Financial Statements

- 2020 Audited Financial Statements

- 2019 Audited Financial Statements

- 2018 Audited Financial Statements

- 2017 Audited Financial Statements

- 2016 Audited Financial Statements

- 2015 Audited Financial Statements

- 2014 Audited Financial Statements

- 2013 Audited Financial Statements

- 2012 Audited Financial Statements

- 2011 Audited Financial Statements

- 2010 Audited Financial Statements

- 2009 Audited Financial Statements

- 2008 Audited Financial Statements

Federal tax returns

As an independent, nonprofit foundation, The Colorado Trust files a Form 990-PF federal tax return each year. This tax return includes such financial data as the fair market value of all assets, an analysis of revenue and expenses and a complete listing of grants paid.

It is important to note that certain expenses, such as those related to evaluation and communications, are integrally related to The Trust’s grantmaking. These expenses are considered part of total grants made. This is often unclear to readers of the Form 990-PF, as many related grant expenses are categorized under “Operating and Administrative Expenses” (Part I, line 24) separately from all other grantmaking expenses, which are listed under “Contributions, Gifts, Grants Paid” (Part I, line 25). As a strategic grantmaking foundation, the staff of The Colorado Trust is extensively involved in developing, monitoring and disseminating the results of grant-funded work. Classification of these expenses as Operating and Administrative on the Form 990-PF does not reflect the true nature of these expenses.

We post our annual tax return to our website soon after it is filed with the IRS each year. Please click on the links below to view our most recent tax returns.

- 2023 Federal Tax Return

- 2022 Federal Tax Return

- 2021 Federal Tax Return

- 2020 Federal Tax Return

- 2019 Federal Tax Return

- 2018 Federal Tax Return

- 2017 Federal Tax Return

- 2016 Federal Tax Return

- 2015 Federal Tax Return

- 2014 Federal Tax Return

- 2013 Federal Tax Return

- 2012 Federal Tax Return

- 2011 Federal Tax Return

- 2010 Federal Tax Return

- 2009 Federal Tax Return

- 2008 Federal Tax Return